Book Value Calculator Accounting

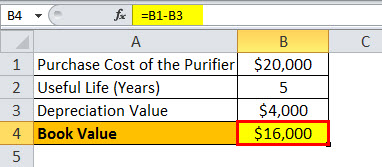

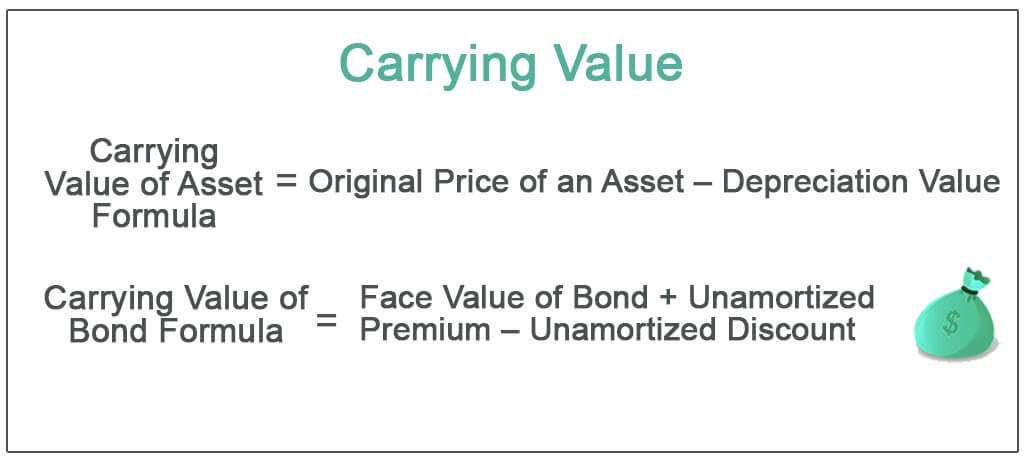

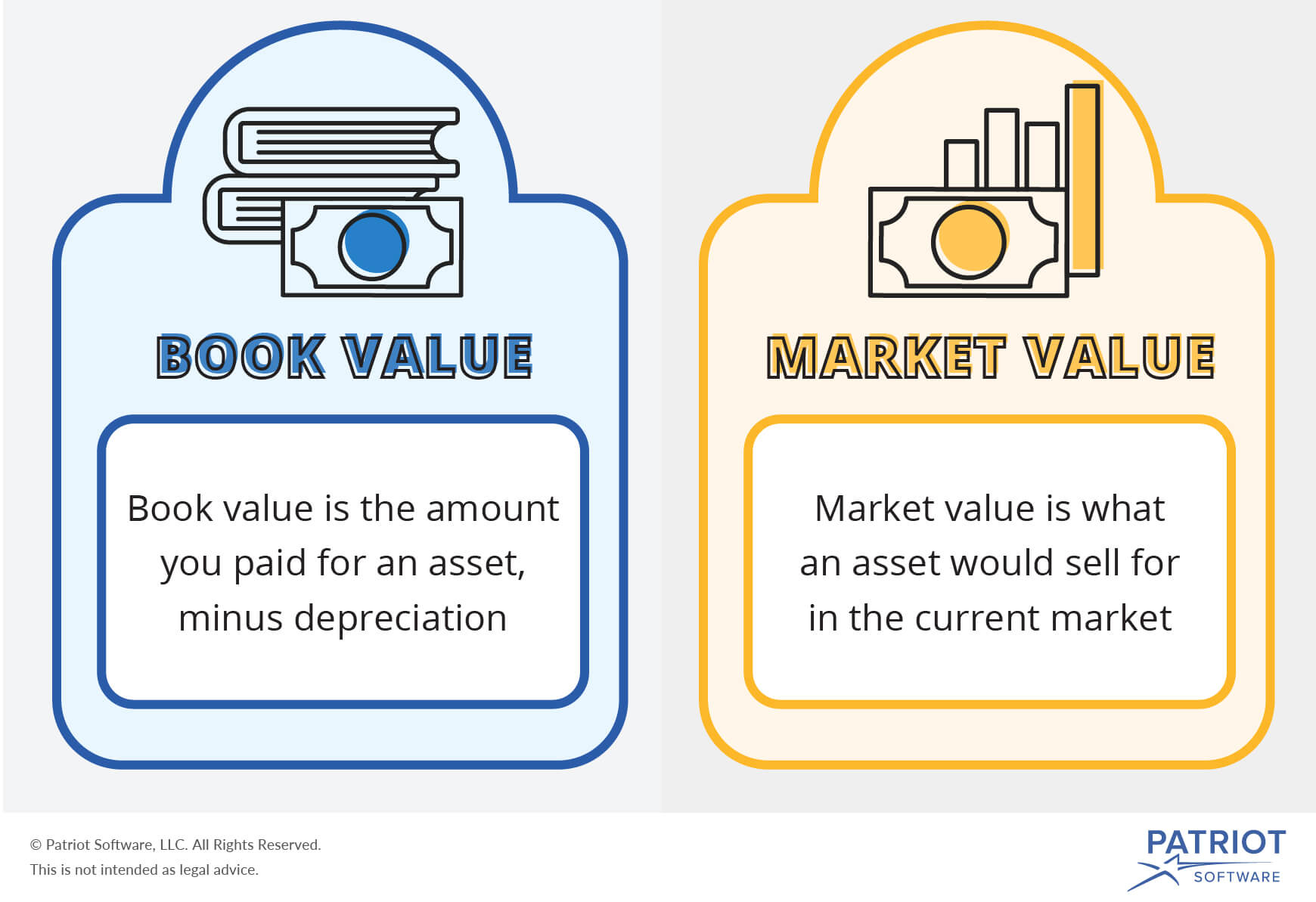

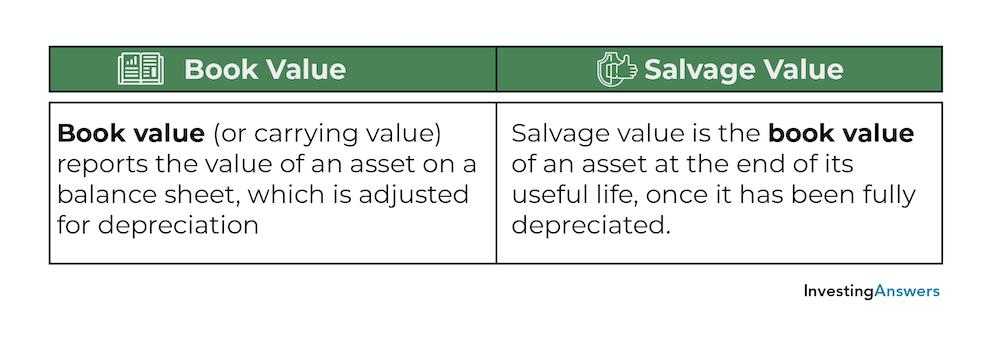

The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. In accounting book value is the value of an asset according to its balance sheet account balance.

Book Value Of Assets Definition Formula Calculation With Examples

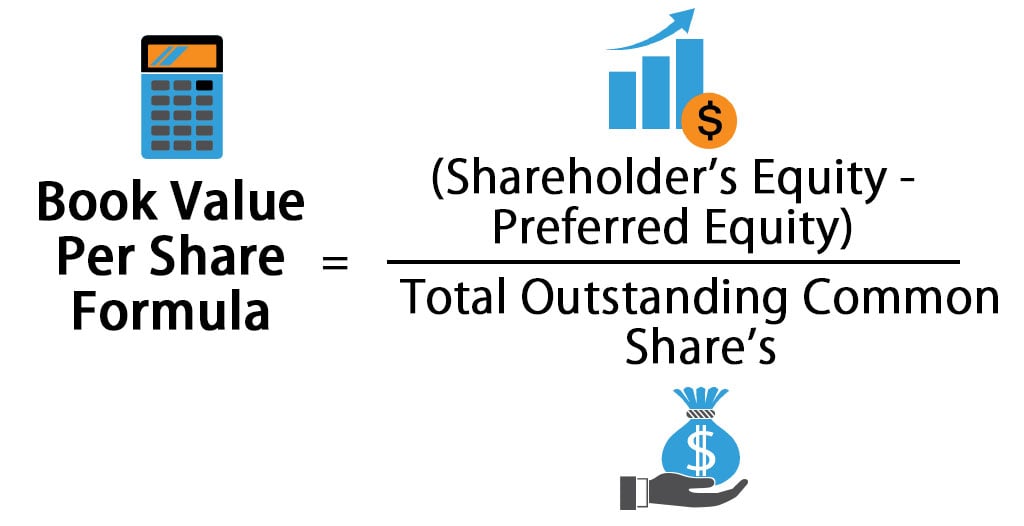

Book value per share is calculated by looking at how much equity the companys assets provide per share of common stock that is issued.

Book value calculator accounting. It is important to realize that the book value is not the same as the fair market value because of the accountants historical cost principle and matching principle. P B x N t S. The first equation deducts accumulated depreciation from the total assets to get the book value amount.

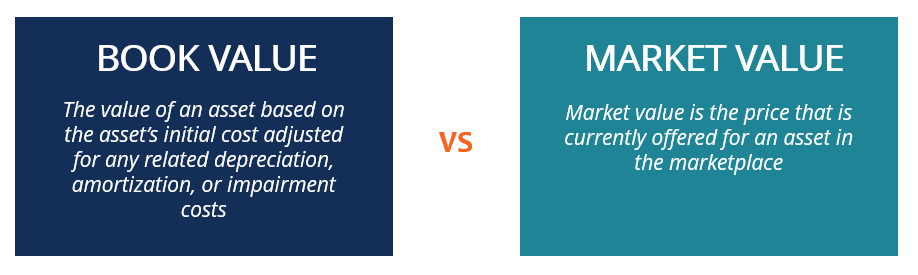

The book value concept is overrated since there is no direct relationship between the market value of an asset and its book value. Calculation of Net Book Value. The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders.

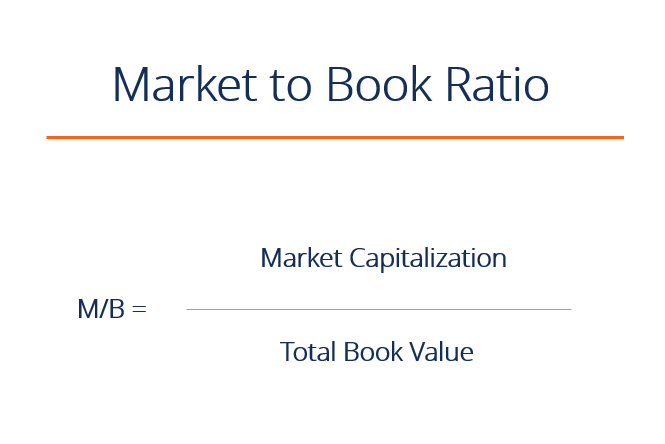

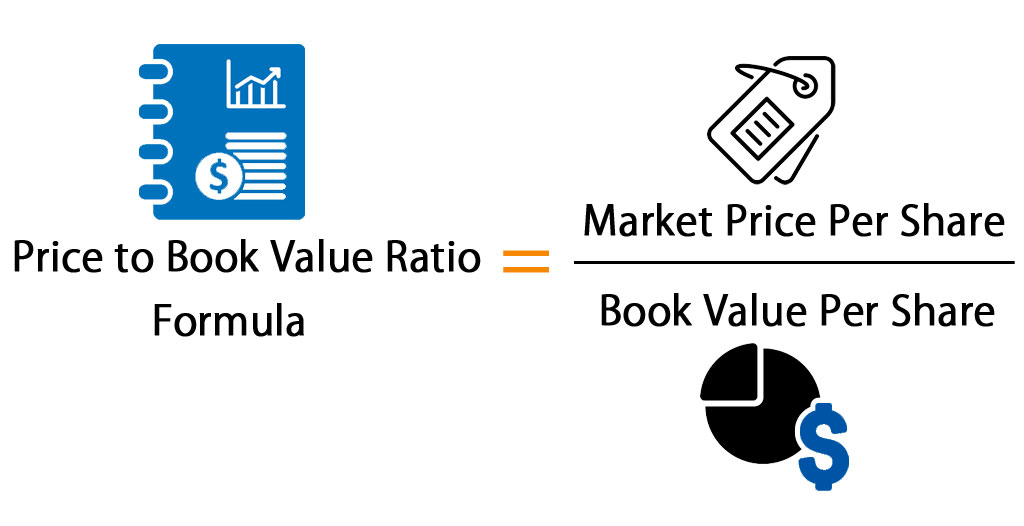

Market to book value ratio is a ratio that simply compares the market value to book value. How to Calculate Book Value the book value formula The calculation of book value includes the. The formula for calculating market to book ratio is a very simple comparison of market value and book value.

The book value per share formula can be expressed as. Depreciation Original cost. In the UK book value is also known as net asset value.

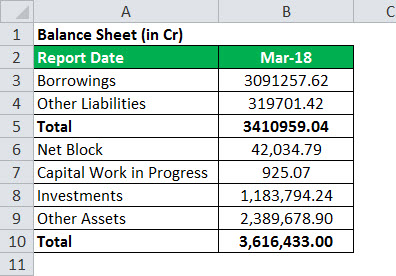

The next step is to calculate the book value of debt by employing the above formula Book Value of Debt Long Term Debt Notes Payable Current Portion of Long-Term Debt USD 200000 USD 0 USD 10000 USD 210000. The value of Company ABCs total assets stand at Rs10 lakh as of 1st May 2020. How to Calculate Book Value per Share.

At best book value can only be considered a weak replacement for market value if no other valuation information is available about an asset. Lets analyze an investment plan with these characteristics. In accounting book value refers to the amounts contained in the companys general ledger accounts or books.

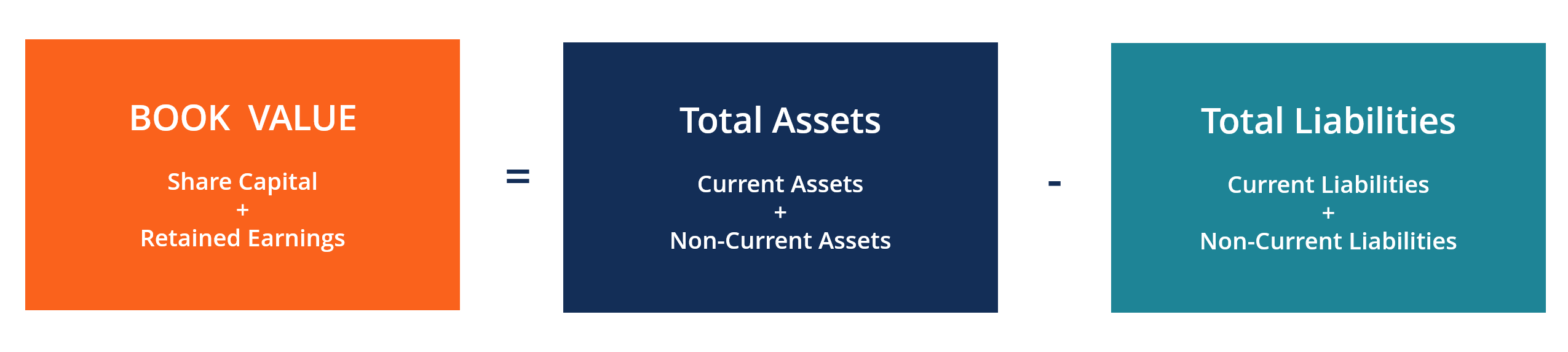

To calculate the book value of a company you subtract the value of its total liabilities and intangible assets from the value of its total assets. 5000000 Average book value. The formula for calculation of NetBook valueNBV.

Accounting rate of return ARRROI. NBV Original cost of the asset Accumulated depreciation. You may also look at the following articles to learn more Calculate Accounts Receivables Turnover Formula.

There are various equations for calculating book value. What is Book Value. Common stockholders equity or owners equity can be found on the balance.

How Book Value of Assets Works. It shows the current position of the asset base after liabilities are taken into account. For assets the value is based on the original cost of the asset less any depreciation amortization or impairment costs made against the asset.

Book Value formula calculates the net asset of the company derived by total of assets minus the total liabilities. It essentially checks how many times of book value the investors are valuing the business. Therefore the book value is 85 Calculating the Present Amount or Worth when the Book Value the Salvage Value the Total Estimated Life of the Asset and the Number of years of the Asset is Given.

Alternatively Book Value can be calculated as the. Inventory Turnover Ratio Formula. Example of a calculation.

The assets cost minus the assets accumulated. - initial investment 100000 - working capital used 200000 - scrap value 50000 - total accounting profit registered 500000 - period 10 years. All in One Financial Analyst Bundle 250 Courses 40.

Book value is the net value of assets within a company. We also provide you with Price to Book Value Calculator with downloadable excel template. The formula for calculating book value per share is the total common stockholders equity less the preferred stock divided by the number of common shares of the company.

This gives Microsoft an estimated book value of 124 billion. BVPS Shareholders equity or Net value of assets total number of outstanding shares. Where Accumulated depreciation depreciation per year x total no of years.

This helps give insight into how much would be paid out per share if a company were to liquidate its assets. The term book value is a companys assets minus its liabilities and is sometimes referred to as stockholders equity owners equity shareholders equity or simply equity. Calculator of Shares Outstanding Formula.

Preferred Dividend Formula Template. Book value may also be. Book value of an asset is.

How to Calculate Book Value To calculate the book value of an asset you subtract its accumulated depreciation from its original cost. The aggregate value of all its liabilities amounts to Rs6 lakh. Formula for Calculating Market to Book Ratio.

Net Book Value Meaning Formula Calculate Net Book Value

Book Value Formula How To Calculate Book Value Of A Company

Book Value Of Assets Definition Formula Calculation With Examples

Carrying Value Definition Formula How To Calculate Carrying Value

How To Calculate Book Value 13 Steps With Pictures Wikihow

Market To Book Ratio Price To Book Formula Examples Interpretation

Book Value Definition Importance And The Issue Of Intangibles

How To Calculate Book Value 13 Steps With Pictures Wikihow

What S The Difference Between Book Value Vs Market Value

Price To Book Value Formula How To Calculate P B Ratio

Book Value Formula How To Calculate Book Value Of A Company

What Is Book Value Book Value Definition

Book Value Per Share Formula Calculator Excel Template

Book Value Meaning Formula Example Investinganswers

Book Value Per Share Bvps Overview Formula Example

How To Calculate The Book Value Per Share Quora

How To Calculate Book Value 13 Steps With Pictures Wikihow

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Market Value Vs Book Value Overview Similarities And Differences

Post a Comment for "Book Value Calculator Accounting"